EU and US Offer Diverging Trade Deals Creating Global Market Turmoil

EU‑US Trade Deal: Conflicting Statements Emerge

Both Brussels and Washington are now presenting opposing narratives regarding the new trade pact between the European Union and the United States. While the European Commission touts a broad, constructive agreement aimed at leveling the playing field for businesses across both continents, the White House insists that the deal is more limited in scope and primarily serves to cement existing trade relationships rather than overhaul them.

Key Points of Divergence

- European Commission claims the agreement covers a wide range of sectors, from digital services to sustainability standards, and seeks to “eliminate structural barriers.”

- Washington’s position emphasizes that the pact focuses on “enhancing cooperation” and “strengthening traditional ties” rather than introducing radical reforms.

- Both sides acknowledge the deal’s aim to address “critical trade concerns,” but they differ on how deep these solutions run.

- Ambiguities in the text allow for multiple interpretations, fostering the current disagreement.

Implications for Businesses

Companies operating in both regions are advised to monitor the evolving interpretations closely. Depending on which version is adopted, there could be significant changes to tariffs, data flow regulations, and environmental compliance requirements.

Looking Ahead

Stakeholders in Brussels and Washington are scheduled to engage in a series of meetings intended to clarify the deal’s details further. The outcome of these discussions will determine whether the EU-US partnership truly becomes a comprehensive trade framework or remains an incremental adjustment of existing agreements.

EU‑US Trade Talks Start in Turbulent Terrain

After a face‑to‑face summit in Scotland between European Commission president Ursula von der Leyen and former U.S. president Donald Trump, a preliminary agreement surfaced. Yet the pact immediately attracted sharp criticism, with many pointing out its pronounced tilt toward American interests.

Monday: Brussels Champions Stability

Throughout the day, the European Commission geared up journalists, portraying the accord as a bedrock of stability amid global uncertainty. They labelled the deal “necessary, albeit hard to digest,” a crucial step to ward off a potentially catastrophic tariff clash across the Atlantic.

White House Responds with a Counter‑Narrative

Later that evening, the White House released a fact sheet that contradicted key aspects presented by Brussels. The U.S. version offered several mismatched claims, sowing seeds of confusion and debate.

Tuesday: Brussels Fires Back

Brussels replied promptly with its own statement, adding another layer of bewilderment to the unfolding story.

Media Spotlight on the Clash

- Examining the broader trade implications.

- Assessing risks of a transatlantic tariff showdown.

- Scrutinizing how each side crafts public perception.

According to Euronews, the conflicting narratives underscore the delicacy of the deal and the divergent interpretations that have emerged.

Pharmaceuticals

EU Pharmaceuticals at a Crossroads with U.S. Tariff Policy

White House’s Directive

- Starting 1 August, most pharmaceutical goods produced in the EU will face a blanket 15 % tariff.

EU Commission’s Current Stance

At the moment, the Commission has opted to keep pharmaceuticals under the existing 0 % tariff rate, pending the conclusion of the Trump administration’s Section 232 inquiry into the sector.

Key Statements from EU Officials

- “There will be no tariffs on pharmaceuticals this Friday,” announced a senior official.

- “The current 0 % rate will remain until the investigation concludes, and no additional duties will be imposed beyond the 15 % ceiling,” clarified the Commission’s expectation.

- European Commissioner for Trade, Maroš Šefčovič, expressed confidence: “I believe that this commitment will be honored and respected in this case.”

Energy purchases

European Union’s Commit to Boost American Energy

White House Projections

The U.S. administration estimates that the European Union will increase its purchases of American energy by “double‑dipping” over the next several years, targeting a total spend of $750 billion. In practice, this translates to about $250 billion each calendar year, beginning during the current administration and continuing into the next.

EU Commission’s Clarification

Representing all 27 member states, the European Commission states it does not possess the authority to fix the exact quantity, type, or provenance of the energy that governments or companies in the bloc might procure. Consequently, it cannot legally bind the Union to the $750 billion ambition.

Strategic Rationale Behind the Numbers

That figure is essentially a forecast based on the EU’s planned reduction of Russian fossil‑fuel consumption in the coming years. It underscores a growing reliance on U.S. liquefied natural gas (LNG) as part of that transition.

Commercial Context of the Deal

The Commission clarified that the U.S. government is neither purchasing nor selling the commodities involved. The decisions are strictly commercial, made by private enterprises that purchase and sell the fuels.

- The annual $250 billion includes ordinary American fuel acquisitions, typically ranging from $92 billion to $100 billion.

- It also covers investments in technology and infrastructure related to energy supply.

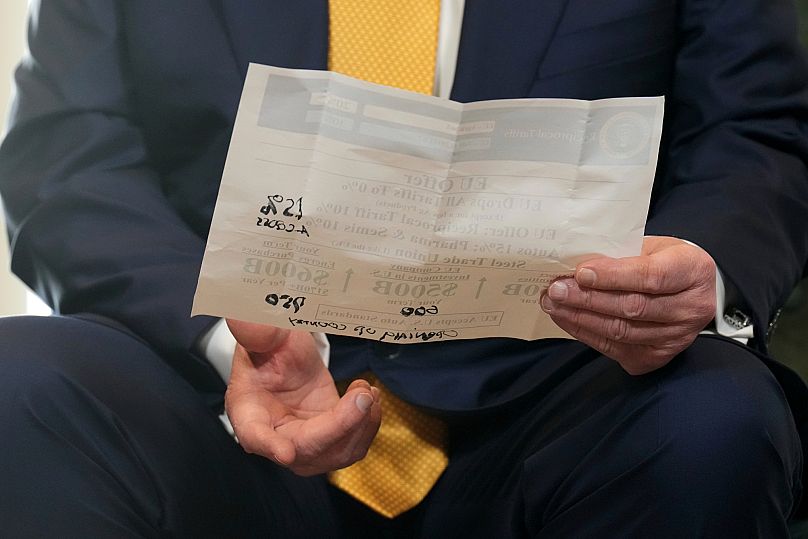

Trump’s Close‑up After Finalizing Deal

Snapshot Captured by AP Photo

In a recent press event, former President Donald Trump was photographed in a close‑up by AP Photo immediately following the confirmation of a new deal. The image reveals him standing confidently, appearing satisfied with the agreement that has just been sealed.

- Key Moment: The photo captures the exact instant after the deal’s signing, highlighting Trump’s reaction.

- Emotional Tone: Trump’s expression reflects a mix of relief and triumph, signaling a positive outcome for his campaign.

- Implications: This engagement marks a significant step in the political and business landscape, potentially influencing forthcoming negotiations.

Investment pledge

White House Claim on EU Inflows

The administration projects that European entities will pour a total of $600 billion into the United States before the conclusion of President Trump’s second term. According to the fact sheet, this sum complements the annual $100 billion-plus that EU firms already channel into the U.S. economy.

Commission’s Perspective

- Investment decisions by the European Union’s public bodies cannot be made on behalf of individual companies.

- Private enterprises’ commitments inform the projected $600 billion figure.

- A senior official emphasized that this estimate is based on the intention of private actors rather than a formal guarantee from the EU.

Potential Downsides

The aggregate sum may decrease once the repercussions of the EU‑U.S. trade agreement, which disfavors the bloc, become evident.

Overall Assessment

Despite the uncertainties, the White House treats these investment and energy pledges as definitively secured.

Weaponry

EU and U.S. Defence Dynamics: A Recount of Recent Position Statements

White House Perspective

- The fact sheet from Washington states that the European Union “agreed to procure sizeable amounts of U.S. military equipment.”

- It makes no reference to any specific monetary value.

European Commission Response

- The Commission emphatically denies any commitment to increase purchases of American-made arms.

- It explicitly rejects claims that it has promised a higher defence spend in Europe.

Why Brussels is Cautious

- Defence remains a strictly national competency, a prerogative guarded by each member state’s capitals.

- Although President von der Leyen has championed ambitious growth in defence budgets, the ultimate allocation—whether funds are expended and where—belongs solely to national decision‑makers.

Commissioner’s Clarification

“Arms procurement is not a matter for the Commission,” the senior official clarified.

“It reflects President Trump’s expectation that a rise in European defence spending would advantage U.S. defence firms due to the perceived quality of U.S. equipment. However, no figures were calculated or discussed in these deliberations.”

Handshake Signifies Diplomatic Moment between EU Leader and Former US President

At the conclusion of an international forum, Ursula von der Leyen, the President of the European Commission, and Donald Trump—the 45th President of the United States—grew a brief but notable handshake in front of an attentive audience.

Context of the Meeting

The gathering, held in a neutral venue, aimed to discuss bilateral cooperation in areas such as trade, climate policy, and security. While details of the discussion remained confidential, the leaders showed respect for each other’s positions through a courteous physical gesture.

Key Highlights

- Ceremonial timing: The handshake occurred immediately after the plenary session concluded.

- Symbolic significance: It served as a visual reminder of the importance of diplomatic cordiality amid divergent political agendas.

- Public reaction: Media outlets and social platforms quickly captured and shared the moment, sparking debate over the implications for future negotiations.

Photographic Documentation

The image captured by photographer Jacquelyn Martin will appear in the archives of the event, ensuring that this fleeting exchange is preserved for historical records.

Steel and aluminium

White House Stance on Steel and Aluminium Tariffs

The United States administration continues to uphold the existing 50% tariff for steel and aluminium imports from the European Union, citing the Section 232 review carried out under former President Trump.

According to a recent fact sheet, the new tariff framework aims to generate tens of billions of dollars in annual revenue, while also addressing the chronic trade imbalance between the U.S. and Europe. It seeks to:

- Encourage local sourcing and the reshoring of production.

- Ensure foreign producers contribute a fair share to the American economy.

European Commission’s Position

The EU argues that the agreement introduces a quota-based system to resolve the enduring dispute. Under this model:

- Exports from the EU that remain within the designated quota will benefit from a reduced tariff.

- Once the quota is exceeded, the 50% rate will take effect.

Because the deal is still in its early stages, the Commission cannot currently detail the exact operational mechanics of the quota. Their announcement simply notes that the quota will be anchored on historical export levels for steel and aluminium.

Key Differentiations Between the Two Positions

While the White House mentions a pledge to provide “meaningful quotas” for products bound for the EU market, this commitment is limited to U.S. goods destined for European consumers. The Commission, however, emphasizes quotas that apply to EU exports heading to the U.S., underscoring a divergence in how each side views the implementation of these tariff measures.

Digital and agricultural barriers

US‑EU Trade Talks: Regulatory Clash over Food & Digital Trade

Key Points of the New Deal

The latest agreement between Washington and Brussels includes:

- Non‑tariff barriers: Targeting “streamlining requirements for sanitary certificates” for US pork and dairy exports.

- Digital barriers: Commitments to eliminate network usage fees and establish zero duties on electronic transmissions.

White House’s Stance

The administration frames the deal as a move to break down both food‑trade and digital‑trade obstacles, emphasizing the removal of unnecessary hoops for American producers.

EU Commission’s Response

Spokesperson Olof Gill stated:

- The bloc is willing to streamline sanitary certificates and discuss network fees, but that is the extent of its concessions.

- Brussels will retain its right to regulate autonomously at all stages of the system that has earned the trust of its citizens.

- These regulatory frameworks will not be incorporated into the new agreement.

Negotiation Highlights

During the talks, US officials repeatedly criticized the EU’s regulatory structure, singling out:

- Digital rules that hamper data flow.

- Food safety standards that add costs.

- Value‑added tax (VAT) systems considered contentious.

The U.S. called for the abolition of these measures, while Brussels stressed its commitment to keeping its established policies intact.