Europe Job Market Red Flags: Workers Gearing Up for Tariff Impacts

Tariff Trends and Their Repercussions for European Jobs

Quick Snapshot of Recent Changes

- Sharp Increase: Average tariff rates rose 15% in the last quarter, altering the cost structure for many industries.

- Fluctuating Landscape: Some sectors experienced a 5% reduction, highlighting the uneven nature of the policy shift.

- Broader Impact: These fluctuations have sparked debates on competitiveness and market stability across the EU.

How Tariffs Influence Workforce Dynamics

- Supply Chain Adjustments: Companies may shift sourcing to domestic suppliers to mitigate higher import costs, creating new jobs in local production.

- Competitive Pressure: Higher prices can reduce demand for certain goods, leading to potential downsizing in related manufacturing arms.

- Innovation Incentives: Firms are investing in tech-driven efficiencies to offset tariff costs, fostering roles in R&D and automation.

Regional Variations and Expectations

- Northern Europe: Industries there anticipate moderate hiring due to robust trade networks and high adaptability.

- Southern Europe: More vulnerable sectors may face temporary employment cuts as export volumes decline.

- Western EU: Experience a mix of job creation in tech and contraction in traditional manufacturing.

Policy Outlook and Labor Forecasts

- EU Commission Projections: A predicted 10% rise in tariff rates over the next fiscal year could alter employment trajectories.

- Industry Adaptation: Stakeholders are urged to reassess workforce strategies, including cross-training and upskilling.

- Government Support: Emphasis on training programs for sectors most affected by tariffs to cushion the workforce impact.

Key Takeaway

Tariff volatility is reshaping the European employment landscape, demanding agile corporate strategies and proactive policy interventions to safeguard jobs while promoting economic resilience.

What the US Tariff Rollback Means for EU Workers

As the United States considers imposing new tariffs on goods imported from the European Union, much of the public debate has focused on what these duties could do to the continent’s industrial giants and its overall trade balance. Yet one crucial sector remains largely unexamined: the workforce that fuels these businesses.

Potential Shockwaves Across Jobs and Stability

When import duties rise, they typically translate into higher costs for export‑oriented companies. This can trigger a chain reaction:

- Reduced production capacity: Giants such as automotive and aerospace manufacturers may scale back output, leading to fewer production hours and lower workforce demand.

- Supply‑chain disruptions: Multinational firms that rely on just‑in‑time inventories could be forced to re‑evaluate global sourcing strategies, meaning more uncertainty for regional suppliers.

- Labour market contracts: As companies confront tighter margins, they might postpone hiring or shift towards contract‑based labour, undermining the stability of permanent employment.

What to Anticipate in the Next Several Months

In light of the evolving trade policy scene, here are the key developments workers should monitor:

- Policy announcements: Expect detailed tariff schedules to be released in the coming weeks, outlining which products face higher levies.

- Reaction from industries: Sectors most exposed to American imports will start releasing cost‑impact forecasts and may initiate capital‑allocation strategies.

- Government safeguards: EU officials are likely to propose fiscal and social‑security measures to cushion the most vulnerable jobs.

- Labor negotiations: Trade unions will adapt their bargaining positions, demanding protective clauses for at‑risk employees.

The ultimate outcome hinges on how quickly both governments and businesses respond, but the wage of the next few months will be measured not just in tariffs, but in the number of job opportunities that survive the cross‑Atlantic shift.

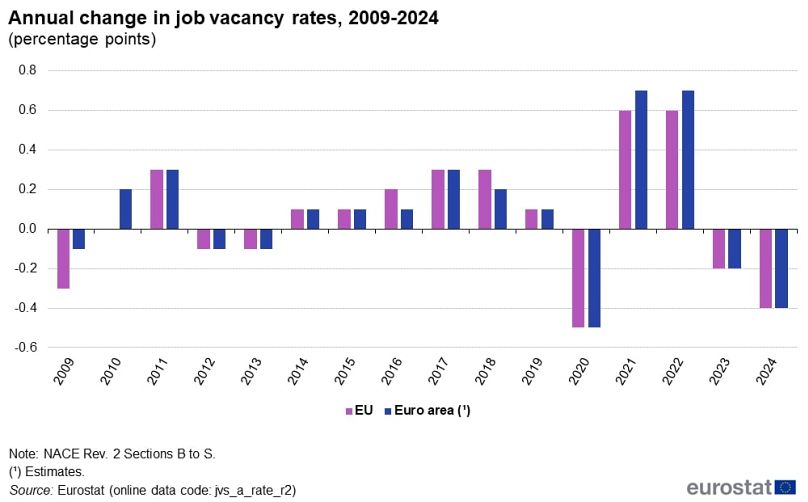

Job vacancy rate

Labour Market Vacancy Trends

An Early Indicator of Market Health

The volume of job vacancies offers a clear early view of business confidence. High vacancy rates suggest that firms feel secure enough to expand their workforce, whereas a decrease points to growing hesitation. When vacancies rise while unemployment remains low, workers benefit from greater choice and stronger bargaining power, reflecting a high-demand, low-supply scenario. Conversely, falling vacancies often signal the onset of a slowdown in hiring activity.

Recent Data from the European Commission

In the first quarter of 2024, the European Commission reported a slight dip in the overall vacancy rate across the eurozone, settling at 2.4 % compared to 2.5 % in the final quarter of 2023.

Year‑Over‑Year Comparison

Looking at the annual change reveals a more pronounced decline: the rate for the first quarter of 2023 stood at 2.9 %, indicating a shift toward caution in hiring practices.

Impact of the Pandemic vs. the 2008‑2009 Crisis

The COVID‑19 pandemic caused a more severe contraction in job vacancies than the 2008‑2009 financial downturn. Although the market rebounded somewhat in 2021 and 2022, vacancy rates have begun to fall again.

Country‑Specific Findings

- Germany: Declines the most, reflecting growing reluctance among employers to expand their teams.

- Greece: Recorded a sharp decrease in vacancy rates.

- Austria: Shows a noticeable drop, indicating cautious hiring.

- Sweden: Experienced the largest reduction in job openings.

Job Vacancy Landscape: Shifting Dynamics and Implications for Employees

Recent data from Eurostat illustrate a continuing decline in job vacancy rates.

Trend Snapshot

- From the first quarter of 2024 to the second quarter of 2025, vacancies fell by 0.4 percentage points.

- The measurable drop signals a contraction in the job market pace.

What This Means for Workers

When fewer openings appear, several consequences unfold for anyone actively seeking new positions:

- Reduced Switching Opportunities – Fewer vacancies translate into limited chances to change roles.

- Weaker Bargaining Power – With slim options, employees often have less leverage to negotiate higher wages.

- Lengthened Re-entry Periods – Those who are laid off may need considerably more time before rejoining the workforce.

Projected Future Scenario

If the downward trend from early 2025 persists, employees could find their negotiation circumstances increasingly strained by year‑end.

Key Takeaway

In a tightening employment landscape, job seekers must adapt strategically to maintain career momentum.

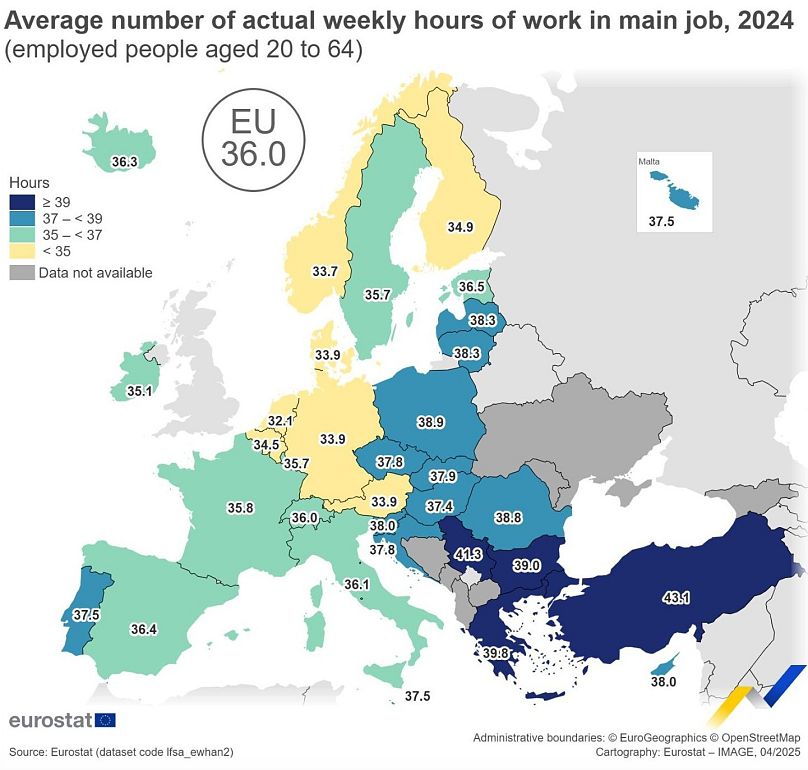

Hours worked and overtime

Working Hours & Shift Reductions in the EU

Employers often respond to declining demand or supply challenges by tightening work schedules. A common early measure is to cut shift hours, which can foreshadow future layoffs or a hiring freeze. When shifts are shortened, overtime opportunities also shrink, further lowering total weekly hours.

Average Weekly Hours Across the European Union (2024)

For the reference week, adults aged 20 to 64 worked an average of 36 hours per week across the EU, combining full‑time and part‑time jobs. The figure reflects the hours devoted to an employee’s primary position.

Countries with the Longest Working Weeks

- Greece – 39.8 hours

- Bulgaria – 39.0 hours

- Poland – 38.9 hours

- Romania – 38.8 hours

Countries with the Shortest Working Weeks in the EU

- Netherlands – 32.1 hours

- Austria – 33.9 hours

- Germany – 33.9 hours

- Denmark – 33.9 hours

Reduced Work Hours Drip Across Scandinavia and EU

Key Insight: Workers in Norway, Finland and Germany enjoy noticeably fewer weekly hours than their continental counterparts.

Recent Statistics from Eurostat

- In Q1 2025, the average number of hours worked fell by 0.3% for the eurozone and the EU as a whole, relative to Q4 2024.

- When measured against the same quarter a year earlier, eurozone hours increased by 0.1%, while the EU experienced a 0.2% decline.

Consequences of Fewer Hours

- Shorter work time often translates into lower wages and diminished benefits, particularly for hourly employees.

- Should the trend persist, lower‑ and middle‑income households—already testing their budgets against rising costs—could feel the strain most sharply.

Underemployment Gains Ground

Even if overall employment numbers appear stable, underemployment—the condition where workers are hired but cannot secure the desired hours—may rise.

In the first quarter of 2025, 10.9% of the EU’s extended labour force was underutilised, equating to approximately 23.6 million people. This highlights that deteriorations in job quality can run deeper than headline unemployment figures suggest.

Labour rights

Europe’s Worker Safeguards Are Worsening

Recent evaluations of labour protections across the globe highlight a worrying trend: the institutional safeguards that protect European workers are on the decline. This erosion of legal protections becomes especially concerning when factoring in potential future economic shocks such as trade tariffs.

Labour Rights Index 2024

The Labour Rights Index offers a 0–100 scoring framework that assesses a country’s commitment to freedom of association, job security, and family responsibilities. Its latest review shows:

- Scandinavian and Mediterranean giants – Norway, Sweden, Finland, France, and Italy – attain a robust 94.

- Central European leaders – Germany scores 88.5, while the UK records an 88.

Even though many EU member nations perform strongly on paper, the index points to persistent legislative gaps. Key deficiencies include:

- Insufficient protection against unfair dismissal.

- Limited guarantees for equal treatment of non‑standard or temporary workers.

These shortcomings mean that, during periods of economic stability, large cohorts of employees remain vulnerable to sudden job loss or deteriorating working conditions.

ITUC Global Rights Index 2025

The ITUC Global Rights Index translates legal weaknesses into real‑world outcomes by tracking violations such as restrictions on strikes, union formation, and justice access annually. Its 2025 report reveals:

- A worst‑ever average score of 2.78 for Europe, up from 2.73 in 2024 and 2.56 in 2023.

- An alarming rapid deterioration from a 1.84 average in 2014 – the steepest decline among all regions worldwide over the past decade.

Notable findings from the ITUC index include:

- Nearly three‑quarters of European countries violated workers’ right to strike.

- Almost a third of these nations detained or arrested protestors.

- More than half denied or restricted access to judicial recourse – a sharp increase from 32% in 2024.

Implications for European Workers

These trends suggest an alarming reality: even without a looming crisis, many employees in Europe face fragile protections. The gap between the legal framework and actual enforcement could lead to greater vulnerability during economic downturns, especially if trade barriers or tariffs further strain labour markets.

What does this mean?

European Labour Market Faces Dual Threats

The latest economic indicators point to a labour market in retreat. Vacancy rates are dropping, working hours are shrinking, and underemployment is on the rise. These shifts suggest that workers may struggle to defend themselves as job security and earnings feel the strain.

Key Indicators of a Fragile Work Market

- Declining Job Openings – fewer vacancies signal a tightening job supply.

- Reduced Working Hours – employers are cutting hours, limiting income and experience gains.

- Rising Underemployment – an increasing portion of the workforce is engaged in work that does not match their skills or full capacity.

Why Tariffs Could Take a Toll Now

Trade shocks such as tariffs are likely to hit harder in 2025, not only because the economy is cooling, but because the institutional safeguards that once helped workers withstand downturns are gradually eroding. The combined pressure could expose workers to unprecedented vulnerability.

Potential Long-Term Consequences

- Job Losses – immediate reduction in employment opportunities.

- Erosion of Bargaining Power – lasting damage to workers’ collective influence over wages and working conditions.

- Wider Socioeconomic Impact – potential for increased economic inequality and social unrest.

The next few quarters will reveal whether these trends are fleeting tremors or the beginning of a deeper downturn for Europe’s workforce. Should tariff pressure and weakened rights persist, the cost could be measured not just in lost jobs but in the enduring loss of worker agency for years to come.